In the column, “Are You In Love or Just Doing a Trade?” I argued against calculating ROI for social. I got a lot of feedback. Some people liked my argument; some people hated it (and thought I was stupid) and passionately educated me on importance of ROI. They also insisted that digital in general has failed to deliver on ROI expectations. They accused me of taking an easy option and not wanting to be accountable.

These reactions made me realise how loosely and randomly advertising industry uses the word ROI. Return On investment as a concept emerged from the world of finance (economics) and advertising industry has just retrofitted it without fully understanding the concept. While I accept feedback with all humility it prompted me to further discuss the topic of digital ROI.

Let me begin by asking simple questions around four important factors in ROI: Money, advice, research, and risk:

How much money are you investing in digital and what is the percentage of digital in your overall marketing budget?

Do you engage the best digital advisors or the cheapest ones?

What percentage of your marketing research budget is spent on digital?

What is your risk appetite and what is the level of risk you’re willing to take?

I request you to answer these questions truthfully. In my experience (spanning over 14 years across different Asian markets) most marketers and ad men seldom answer these questions before demanding great ROI from digital. Let us closely look.

First and foremost any ROI discussion starts with the amount of money that you’re putting on table. Most clients and agencies in Asia allocate single digit percentage budgets to digital. Most often the arguments are:

We have limited or no additional money left for digital.

TV still reaches masses, print is impactful, outdoor is visible and we don’t have enough proof points that digital will deliver.

Digital should be cheap and hence a small budget allocation is sufficient.

Show me the ROI and then I will invest.

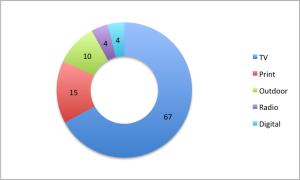

Let us treat each of the mediums as different asset classes. Now if you look at media allocation of any typical Asian client it will look like this:

So even if you get great ROI on digital its relative impact on ROI of overall media is limited. Additionally, different mediums calculate ROI differently and hence it is practically impossible to compare. Even sophisticated models such as market mix modeling are not geared enough to handle complexities of digital and often end up providing biased results in favour of television advertising. Additionally most clients struggle to provide quality data for such models and hence suffer from garbage in garbage out problem.

Secondly, ROI also depends on quality of advisor. Most savvy investor will tell you that quality of advise (on when and where to invest) is very important in realising great returns. Even the smartest investors seek advice from time to time and any such expertise doesn’t come free or cheap. In my observation most marketers want cutting-edge expertise at cutthroat price. Logically, it doesn’t make sense but it is justified by linking it with procurement function and treated exactly like buying stationary. As they say if you pay peanuts, you get monkeys. Unfortunately, it is proving to be true in digital.

Thirdly, research plays an important role in understanding market dynamics and making investments in right platforms. You can randomly invest and get lucky once or twice but in order to repeat success on a sustainable basis you need depth of research. Most marketers spend very little or nothing on research on digital and have no basis to determine attractiveness of various digital platforms.

Finally, it all boils down to risks. Needless to say returns and risks go hand in hand. Marketers want fantastic results with no risks. Any innovation or new approach or new platform carries a higher level of risk but it also provides an opportunity for higher returns.

Just imagine what will happen if you make a financial investment with very little amount of money, without any research on what works and what doesn’t, with a financial advisor who is cheap but not an expert (and actually is more of an accountant rather than a financial advisor) and with a no or low risk approach. I suspect you will get no or negligible returns on your investment. In that case should you blame the financial markets, instruments or your own investment outlook? In real life returns are always linked to the size of investment, depth of research, quality of advice, and levels of risk. I think the same principles work when it comes to digital or any other media.

There is nothing wrong in having great ROI expectations from digital but in order to meet the expectations marketers and their agencies need to increase investment money (at least 15 percent of total media budget), get expert advisors, conduct research, and above all, take risks.

(Originally published in ClickZ.Asia on 10 August 2011)